The “warning signs” look all too familiar.

Escalating home prices have both buyers & sellers worried that the market is just “too good to be true,” and agents across the U.S. are getting bombarded with the ultimate question: “Are we in a housing bubble?”

Let’s take a look at 3 key factors that suggest we’re not, so you can educate your clients and calm fears in your market.

PART 1: HOUSING SUPPLY

Last year, home values appreciated an average of 15% across the nation. And while this year’s growth isn’t expected to match it, buyers and sellers are still worried that home prices are too high and that depreciation is likely to follow.

However, unlike the Housing Bubble years of the mid-2000s, the major factor driving up home values is that we’re also in a dire inventory shortage.

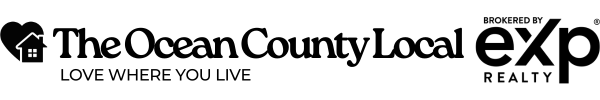

A balanced real estate market’s inventory sits around 6 months. Today’s current market is at 1.7 months, a historically low amount of homes for sale.

In comparison, the inventory level from 2005 and 2007 increased from 5 months to 11 months, a vast over-supply of homes that did not warrant the price appreciation that went along with it.

So, throwing it back to your high school economics class, the biggest driver of price appreciation is a simple case of supply and demand, hence what we’re seeing in the market today.

PART 2: HOUSING DEMAND

If you remember the housing boom of the mid-2000s, you know how crazy that time was in real estate. But if Robert Schiller, a fellow at the Yale School of Management’s International Center for Finance, could sum it up in one phrase, it’s this: irrational exuberance.

In other words, the buying and selling frenzy that contributed to the market collapse was fueled not by tactful, financial decisions but a country-wide case of FOMO (fear of missing out).

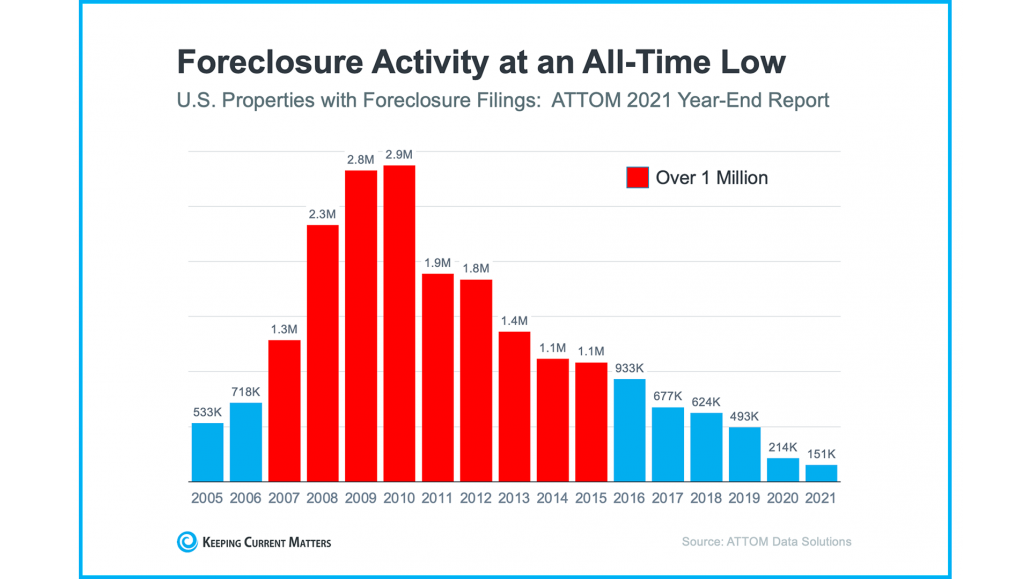

The mortgage industry fed into the frenzy, making it easy for people to obtain home loans much higher than they could afford.

Today’s real estate demand, however, is a very real thing. And lending standards have become much tighter since before the crash.

Plus, with escalating rent happening across the U.S., many Americans are opting for the financial stability that homeownership offers.

These factors, coupled with low mortgage rates, make purchasing a home today a good financial decision. So, not only is the demand very real, it’s also very smart.

PART 3: EQUITY

Following the housing and economic crash of 2008, economists, financiers, and real estate industry experts have combed through data to figure out why the entire system crumbled the way it did.

Most will agree that one of the biggest pieces of that catastrophic equation came down to this: equity. Or in reality, a lack of it.

The mid-2000s saw a massive wave of homeowners cashing out the equity in their homes. In short, they were using their homes like ATMs to afford some of the finer things in life.

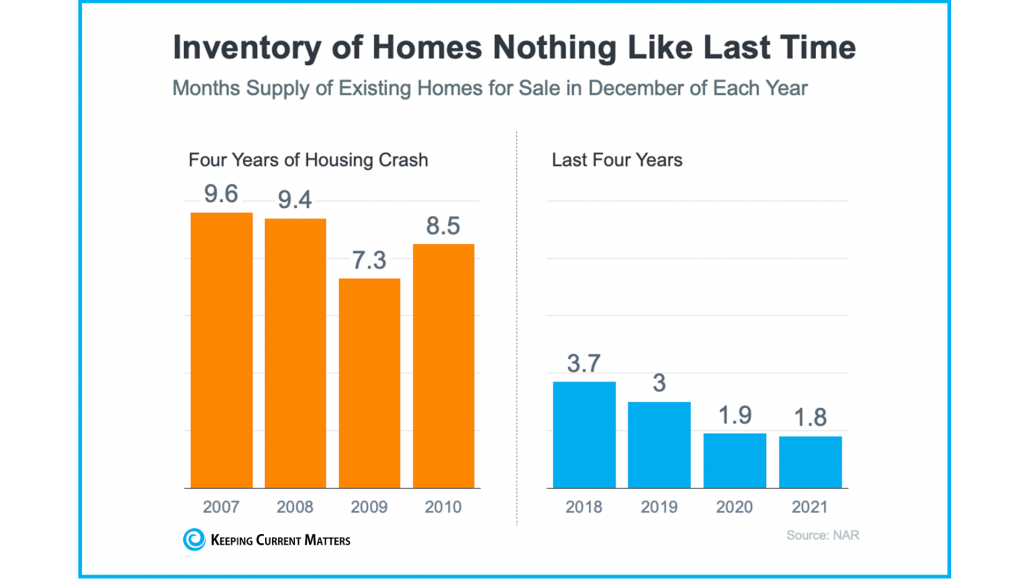

This led to a lot of negative equity situations: where the amount someone owed on their home was far more than what their house was worth. Many foreclosures and short-sales followed, depreciating home values nationwide.

Today is a much different equity picture. Cash-out refinance volume over the last three years is less than a third of what it was compared to the three years before the crash. Plus, escalating appreciation meant that homeowners gained an average of $55,300 in equity in the last 12 months alone. As prices continue to rise, equity will too.

This positive equity perspective puts the current housing market in a much stronger place, minimizing risk of foreclosure and stabilizing home values across the U.S.

BOTTOM LINE

The most important role of a real estate agent is to be the educator to their clients.

What that really means is analyzing data and insights, getting all sides of a story and then being able to communicate that so your clients can make the best real estate decision.